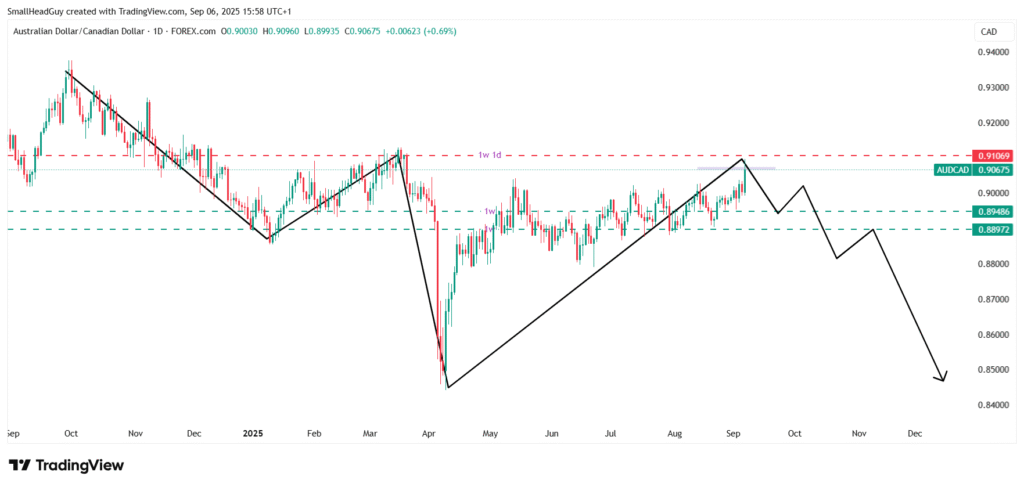

AUDCAD Price Forecast: Bearish Reversal at 0.90700 After Rejection

Scroll Down For ID

previous report : AUDCAD Price Forecast: Watching for a Bearish Setup After Potential Bullish Breakout 29 AUG 2025

Overview

This is an updated outlook on AUDCAD. In our previous forecast, we identified 0.90700 as the critical resistance level. Price has since reached this level and produced a sharp rejection on the daily chart. This signals a shift to the bearish side.

For the coming week, we expect price to remain below 0.90700, ideally retracing slightly toward 0.91050 to capture liquidity before easing down. Our target zones are clearly defined at 0.89400 and then 0.88700, providing a structured path for a sell-side swing strategy.

Technical Analysis

Daily Chart: Bearish Rejection Confirmed

On the daily timeframe, AUDCAD rallied into 0.90700, aligning with strong resistance. However, a large bearish candle emerged from that area, showing rejection and a failure of bulls to push higher. This suggests bearish continuation in the near term.

Short-Term Retracement Opportunity

As the market often retests resistance before continuing, a move back toward 0.91050 is possible. This area offers an attractive entry for sellers if price stalls again.

4H and 1H Charts: Tracking Momentum

- 4-Hour Chart: Price is showing signs of weakening momentum. A retracement to 0.91050 could occur before sellers regain control.

- 1-Hour Chart: Watching for bearish candlestick patterns, such as engulfing formations or lower highs, around resistance will help refine entry timing.

Target Zones Defined

- First Target: 0.89400 — key short-term support.

- Second Target: 0.88700 — medium-term support where sellers may lock in profits.

Invalidation Level: A sustained daily close above 0.91050 would invalidate the bearish setup and open the door to more upside.

Monetary Policy & Macro Fundamentals

Reserve Bank of Australia (RBA) — Dovish but Data-Dependent

The RBA recently cut its cash rate to 3.60%, its third cut this year and the lowest in two years. Policymakers are cautious, balancing slowing inflation with weaker growth. Australia’s economy expanded 0.6% in Q2, its fastest pace in nearly two years, driven by consumer spending. However, inflationary risks and fragile employment conditions are limiting the RBA’s ability to pause cuts.

The overall stance remains dovish, but the central bank is taking a gradual approach to further easing.

Bank of Canada (BoC) — Nearing End of Easing Cycle

The BoC recently held its policy rate at 2.75% after several rounds of cuts earlier in the year. Analysts believe the central bank may be approaching the end of its easing cycle, with expectations of two more cuts by year-end. Canadian data, including weaker labor market conditions, continues to support the case for mild easing, but not aggressive cuts.

This relatively cautious approach makes CAD slightly more resilient compared to AUD, where the RBA is still more dovish.

read more: EURJPY Price Forecast: M-Pattern Signals Potential Bearish Reversal 4 SEP 2025

Combined Technical & Fundamental Outlook

- Technically, AUDCAD has topped out near 0.90700, confirming resistance. The bearish rejection candle suggests sellers are active.

- Fundamentally, both the RBA and BoC lean dovish, but the RBA’s more aggressive easing path weighs heavier on AUD.

- Taken together, these conditions align with a sell-on-retest strategy, focusing on liquidity grabs near 0.91050 before a decline toward 0.89400 and 0.88700.

Trading Plan

| Step | Action |

|---|---|

| Wait for retracement | Watch for price to approach 0.91050 for signs of exhaustion or rejection |

| Enter Short | At or below 0.90700 after bearish confirmation (daily close or rejection) |

| Stop-Loss | Above 0.91050 to protect against false breakout |

| Targets | 0.89400 (first target), 0.88700 (second target) |

| Bias | Bearish unless price sustains above 0.91050 |

Conclusion

AUDCAD has validated our earlier forecast by rejecting the 0.90700 resistance level on the daily chart. The technical structure favors sellers, with a likely retracement toward 0.91050 providing another chance to position short. Downside targets are clear at 0.89400 and 0.88700.

From a macro perspective, the RBA’s dovish policy stance and ongoing rate cuts make the Australian dollar vulnerable. In contrast, the BoC’s more cautious easing approach adds slight support for CAD. As long as price remains capped below 0.91050, the bearish outlook for AUDCAD remains intact, setting up a potential swing trade opportunity.

read more: EURCHF Price Forecast: Bulls Eye 0.95200 After Breakout 1 September