Scroll Down For ID

read more: AUDCAD Price Forecast Update Big Falls Starts Soon 6 SEPTEMBER 2025

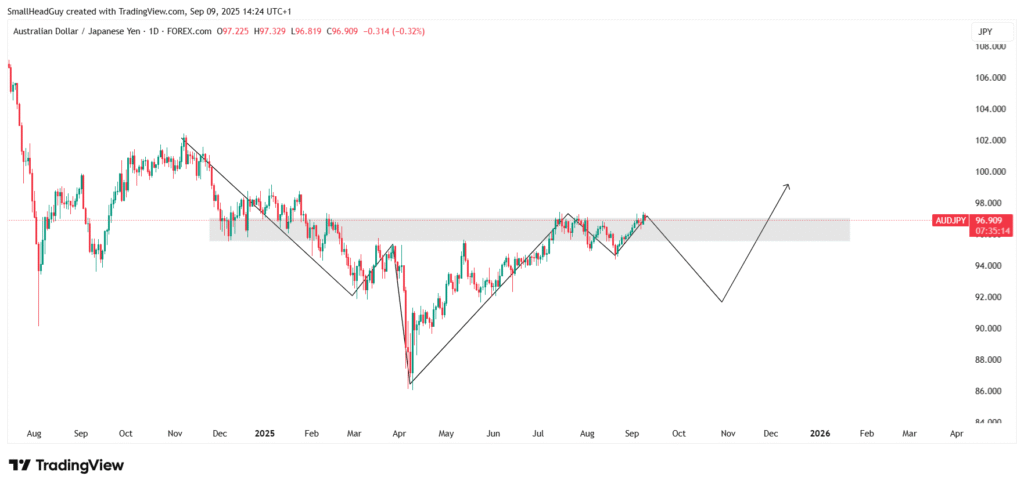

Technical Outlook (Daily Timeframe)

AUDJPY is currently trading near a formidable resistance zone around 96.90. Price has been consolidating around this level for several sessions, signaling indecision between bulls and bears. Based on our analysis, a short-term downward correction is likely to sweep up pending liquidity before a potential breakout to the upside.

We anticipate the pair will dip to approximately 91.60, where price may find support on the daily chart. After this pullback, we expect the market to regain buying momentum and eventually break above the existing resistance zone.

Key Levels

- Current Price: ~96.90

- Immediate Resistance: ~96.90

- Bounce Area (Potential): ~91.60

- Upside Breakout Path: Likely follows stabilization post-91.60 dip

The 96.90 level must cap price for the bearish setup to remain valid. If AUDJPY stabilizes below this level, traders should look for bearish reversal setups—such as an engulfing candle or lower highs formation—to initiate short entries. On the downside, 91.60 emerges as a logical entry zone for buying into a breakout.

Fundamental Drivers

Reserve Bank of Australia (RBA)

The RBA recently eased its cash rate to the mid-3% range, driven by moderating inflation and slowing domestic activity. Analysts project further gradual cuts—totaling approximately 80 basis points over the next year—driven by weak global growth and persistent uncertainties.

The dovish RBA supports AUD weakness in the near term, reinforcing the technical setup prompting a potential pullback in AUDJPY.

Bank of Japan (BoJ)

The BoJ has held its policy rate at 0.5%, its highest in over 17 years. The bank is committed to a cautious normalization path, reducing its bond-buying program gradually while monitoring inflation and financial conditions closely.

Recent market and political developments—including uncertainty over leadership—could delay further tightening, keeping the yen relatively weak.

BoJ’s dovish-leaning stance, juxtaposed with the RBA’s easing, creates a complex dynamic—but overall may favor temporary downside in AUDJPY before any sustained breakout.

read more : NZDJPY Forecast bulls taking control 29 AUG 2025

Combined Analysis Snapshot

| Factor | Recent Update | Impact on AUDJPY |

|---|---|---|

| RBA Policy | Dovish, easing path | Pressures AUD lower—supporting short-term pullback |

| BoJ Policy | Steady, cautious tightening | Yen remains soft—limits sharp AUDJPY declines |

| Technical Setup | Daily consolidation at 96.90 | Sets up for a short-term drop to 91.60, then potential breakout |

Trading Plan

- Setup Watch: Wait for AUDJPY to dip from the current resistance (~96.90).

- Entry for Short: Ideal short entry comes below 96.90 after confirmation (e.g., bearish candle close).

- First Target: ~91.60 — capture the downside move.

- Reversal Zone: Once near 91.60, monitor for bullish setups before considering long positions.

- Stop-Loss Placement: Above 96.90 to protect against false breakouts.

Conclusion

AUDJPY is likely to stage a quick retracement from the current resistance zone before any breakout plays out. Price retesting near 91.60 would offer compelling value for short-term bounce setups and position traders for the next break above 96.90.

Technically, the pair remains trapped until a decisive move. Fundamentally, the divergence between RBA easing pressure and BoJ’s cautious tone sets the stage for this corrective move. Watch for bearish signals into 96.90, then primary support at 91.60.

read more : USDJPY Bearish Breakout: Fibonacci Levels, Consolidation, and Trading Strategy 27 AUG 2025