Technical Overview

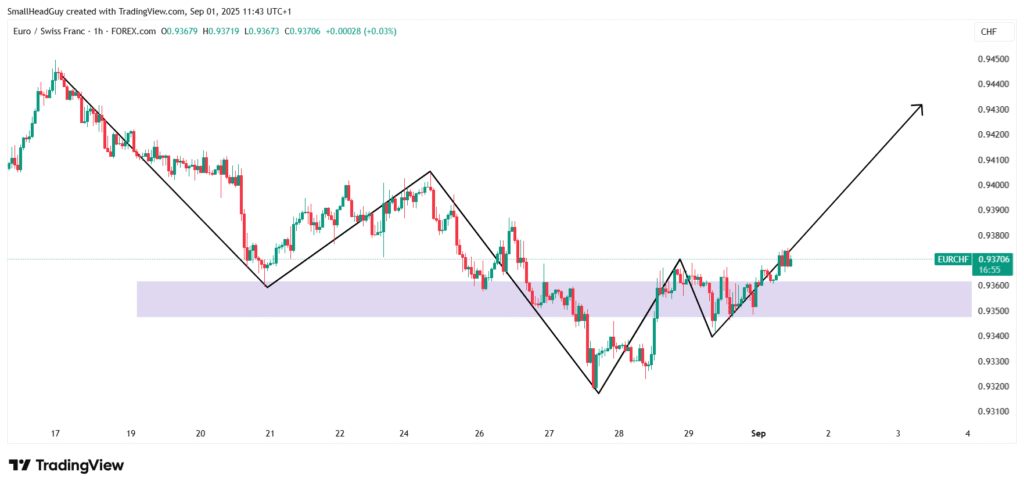

EURCHF has finally made a decisive move after spending weeks consolidating between 0.93100 and 0.93700. This consolidation phase kept the pair locked in a tight range, frustrating both bulls and bears, but the breakout suggests momentum is shifting toward the upside.

- 1-Hour Time Frame: The structure initially appeared bearish, marked by lower highs and lower lows. However, the breakout has challenged this pattern. If price continues to close above 0.93400, the 1-hour structure will fully transition to bullish, signaling that short-term buyers are in control.

- 4-Hour Time Frame: The bearish structure has already been compromised, but confirmation of a new bullish structure is still pending. Traders should look for higher highs and higher lows to validate the shift.

- Daily Time Frame: The larger picture supports the bullish case. With the breakout, the next logical target sits at 0.95200, a level that aligns with both historical price reaction zones and Fibonacci extensions.

Trading Bias: For now, the trade idea is simple—look for buy entries as long as EURCHF holds above 0.93400, with 0.95200 as the upside target.

ECB Monetary Policy and Euro Fundamentals

The European Central Bank (ECB) has been navigating a challenging environment of sticky inflation and sluggish growth. As of mid-2025, ECB’s benchmark rates stand at:

- Deposit Facility Rate: 2.00%

- Main Refinancing Rate: 2.15%

- Marginal Lending Facility: 2.40%

The ECB has shifted toward a more dovish stance, suggesting rate cuts could continue if inflation keeps easing toward the 2% target. This stance generally weakens the euro, but in EURCHF, the impact is offset by the Swiss National Bank’s aggressive easing.

Furthermore, risk sentiment across global markets plays a role. When investors seek risk, the euro tends to gain against the safe-haven franc. Thus, even with dovish ECB policy, positive risk appetite can fuel EURCHF’s rise toward 0.95200.

read more : EURGBP Forecast Update: Retracement Before Major Bearish Move (August 26, 2025)

SNB Monetary Policy and Swiss Franc Outlook

The Swiss National Bank (SNB) has been forced to act aggressively in 2025 to counter deflationary pressures:

- In June 2025, the SNB cut interest rates by 25 basis points to 0.00%, marking its sixth consecutive cut.

- Inflation fell to –0.1% y/y in May, a negative reading that justified policy easing.

- Officials have also signaled they are prepared to use foreign exchange interventions if necessary to prevent excessive franc appreciation.

Adding to speculation, sight deposits at the SNB rose by CHF 11.2 billion in July 2025, raising the possibility that the central bank has already been intervening behind the scenes to weaken the franc

This backdrop makes the franc vulnerable to further depreciation. With ECB policy easing being more gradual than the SNB’s aggressive cuts, the fundamental case leans in favor of EURCHF upside continuation.

Macro Drivers Beyond Central Banks

- Global Risk Sentiment

The Swiss franc is one of the world’s premier safe-haven currencies. If global equity markets remain stable and volatility remains low, capital tends to flow out of the franc, pushing EURCHF higher. Conversely, a surge in risk aversion could halt or reverse the pair’s bullish move. - Energy Prices

As the eurozone is heavily reliant on energy imports, fluctuations in oil and gas prices affect the euro. Lower prices ease inflationary pressure and support growth, indirectly benefiting the euro. - Swiss Exports

The SNB closely watches franc strength as it impacts Swiss exporters. A strong franc reduces competitiveness. This increases the likelihood of SNB intervention if EURCHF dips too low.

Trade Strategy and Key Levels

- Entry Zone: Above 0.93400, once a bullish candlestick close confirms strength.

- First Target: 0.95200, aligning with the daily projection and Fibonacci resistance.

- Potential Extension: If bullish momentum accelerates, the next level to monitor is 0.96000, though this is a secondary scenario.

- Invalidation Level: A sustained drop back below 0.93400 would invalidate the bullish bias and suggest the breakout was false.

Risk Management: Place stops just below 0.93400 to minimize exposure in case of a reversal.

Scenarios to Watch

- Bullish Scenario: Price sustains above 0.93400, continues higher, and reaches 0.95200. This aligns with both technical breakout and fundamental divergence between ECB and SNB policy.

- Bearish Rejection: If EURCHF fails to hold above 0.93400 and drops back into the consolidation range, sellers may regain control, pulling price back toward 0.93100.

Conclusion

The EURCHF breakout above the 0.93100–0.93700 consolidation zone has opened the door for a bullish continuation, with 0.95200 as the primary upside target.

While the ECB’s dovish stance limits euro strength, the SNB’s more aggressive policy easing, deflation concerns, and possible FX interventions tilt the balance in favor of EURCHF upside. As long as price holds above 0.93400, the trade setup favors buyers.

For traders, this is a market where technical signals and central bank divergence align, offering a well-defined opportunity.

read more : USDCHF Price Forecast : Big sell of expected soon 25 AUG 2025