Scroll Down For ID

Introduction to EURGBP and Current Market Sentiment

The EURGBP pair is one of the most widely traded currency pairs, representing the exchange rate between the euro (EUR) and the British pound (GBP). Traders closely watch this pair because it reflects both Eurozone and UK economic conditions, making it highly sensitive to fundamental and technical developments.

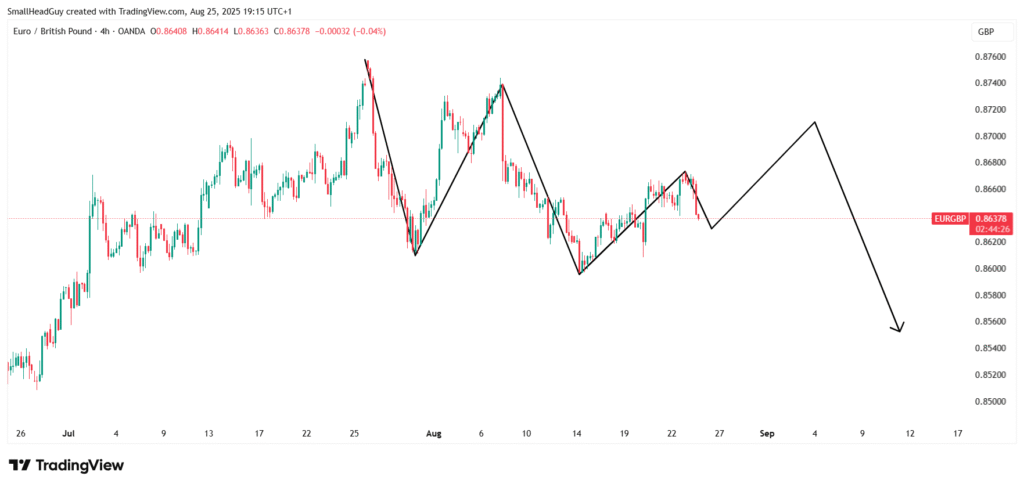

Currently, the EURGBP is showing strong signals of a potential bearish move on the 4-hour timeframe. Market participants have observed a confirmed bearish structure, and price action is hinting at a possible retracement before a significant sell-off. This article explores the technical patterns, market drivers, and trading strategies behind the EURGBP bearish move.

Technical Analysis on the 4-Hour Time Frame

Candle Patterns Signaling Bearish Momentum

The most recent candlestick formations on the 4-hour chart confirm strong bearish momentum. Long wicks and bearish engulfing candles show that sellers are overpowering buyers at critical resistance levels.

Market Structure and Price Action Confirmation

EURGBP has broken below previous higher lows, forming a bearish market structure. This structure suggests the possibility of a trend continuation. Traders use this as confirmation that the pair is preparing for a significant downward move.

Role of Retracement Before a Major Sell-Off

Before price fully commits to the bearish trend, an upward retracement is expected. This pullback allows traders to re-enter short positions at more favorable prices. Fibonacci retracement levels often provide key zones where this retracement could occur. We expecting EURGBP to retrace and go bearish from price between 0.87100 – 0.87250. These levels are based on Fibonacci retracement levels.

Key Support and Resistance Levels to Watch

Short-Term Resistance Zones

- 0.86650 – Recent swing high

- 0.87100– Fibonacci retracement zone

Long-Term Support Areas

- 0.86368 – Fibonacci retracement zone

- 0.86267 – Fibonacci retracement zone

Factors Driving the EURGBP Bearish Move

Eurozone Economic Indicators

Weak GDP growth, soft inflation data, and dovish European Central Bank (ECB) policies have weighed on the euro, contributing to the bearish outlook.

UK Market Fundamentals

The UK economy has shown resilience, particularly in services and labor markets. A hawkish stance from the Bank of England (BoE) further supports GBP strength.

Global Market Sentiment and Risk Factors

Global investors are currently favoring the pound over the euro due to relative economic stability. Any increase in geopolitical risk or inflationary pressures could accelerate the EURGBP bearish move

Trading Strategies for EURGBP Bearish Move

Swing Trading Setups

Traders can look for swing entries during retracements. Selling near resistance with stop-losses above recent highs increases risk-reward potential.

Day Trading Opportunities

Short-term traders may capitalize on intraday pullbacks. Using moving averages and RSI divergence helps refine entries.

Risk Management Techniques

- Keep risk per trade under 2% of account size

- Place stop-losses above resistance

- Scale out profits as price approaches support levels

Tools and Indicators to Confirm the Move

Moving Averages

A bearish crossover of the 50 EMA below the 200 EMA confirms long-term bearish sentiment.

Fibonacci Retracement

The 38.2% and 50% retracement levels are likely retracement zones before continuation.

RSI and Momentum Indicators

RSI dropping below 50 signals bearish momentum. A break under 40 reinforces the bearish bias.

Conclusion: The Outlook for EURGBP Bearish Move

The EURGBP bearish move has been confirmed by technical structure on the 4-hour timeframe. While a retracement is expected, the overall outlook remains bearish, with sellers in control. Traders should watch for resistance levels to position short trades, supported by fundamentals favoring GBP strength over the euro.