Introduction to EURGBP Forecast

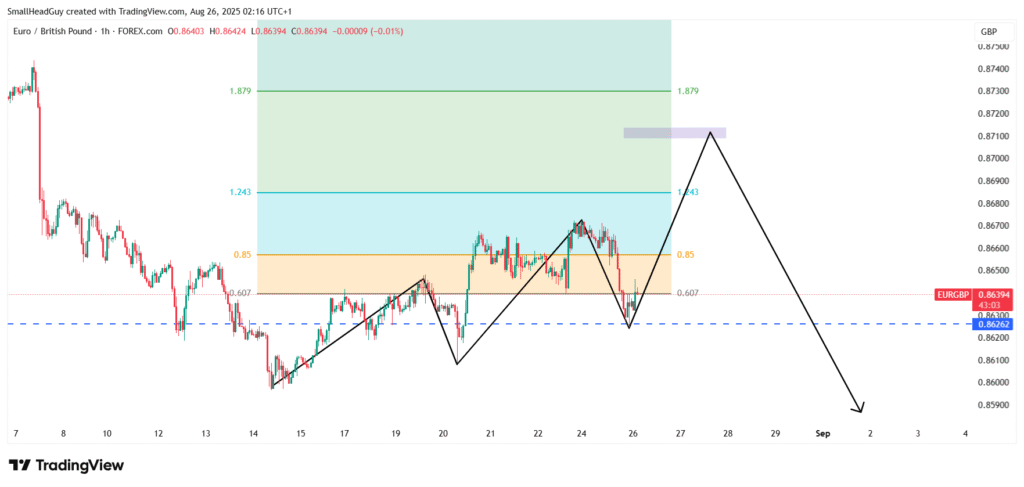

The EURGBP currency pair has been closely monitored by traders following its recent bearish developments. After yesterday’s analysis (August 25, 2025), the market has reacted precisely to the forecasted levels, confirming both Fibonacci-based retracement behavior and a continuation of the broader bearish structure. This update provides a detailed look at how price is unfolding and what traders should expect in the coming sessions.

Recap of Previous EURGBP Analysis (August 25, 2025)

Bearish Outlook Highlighted in Prior Forecast

In the earlier report, we identified EURGBP as being in a larger bearish trend on the 4-hour timeframe. The bias was toward selling after short-term retracements completed.

Key Fibonacci Level at 0.86260 Reached

Price successfully moved down to 0.86260, which was highlighted as a critical Fibonacci level on the 1-hour timeframe. This movement aligned with expectations, confirming that the bearish forecast was accurate.

Current Market Update (August 26, 2025)

Price Reaction from 0.86260 Support

After hitting the 0.86260 Fibonacci level, EURGBP has shown a bullish reaction. This upward move is not a trend reversal but rather a retracement within the larger bearish trend.

Retracement Underway Toward 0.87100

The retracement appears to be targeting the 0.87100 region. This level is significant because it aligns with resistance on the higher 4-hour chart. Traders should view this as a potential zone where selling pressure could re-emerge.

4-Hour Time Frame: Bearish Market Structure Intact

Why Retracement Does Not Change the Bearish Bias

Although price is moving higher in the short term, the overall structure on the 4-hour timeframe remains bearish. Lower highs and lower lows are intact, suggesting the dominant trend still favors sellers.

Confirmation Needed at 0.87100

For the bearish move to continue, traders will need to see EURGBP approach 0.87100 and then show rejection. This could take the form of a strong bearish candlestick or a sell setup forming in that zone.

Trading Plan for EURGBP

Ideal Entry Setup Around 0.87100

The primary strategy is to look for short positions near 0.87100. Entering too early without confirmation increases risk, as retracements can extend further.

Bearish Candle Patterns as Confirmation

Before entering a sell trade, traders should look for bearish candle setups such as:

- Bearish engulfing

- Pin bars with rejection wicks

- Strong momentum candles closing below support

Downside Targets After Reversal

Once a bearish setup forms, the downside targets include:

- 0.86260 as the first immediate support

- Further downside continuation beyond this level if bearish momentum strengthens

Risk Management Considerations

- Always wait for confirmation before entering near 0.87100

- Place stop-losses above retracement highs to avoid false breakouts

- Limit risk to 1–2% per trade

- Scale out partial profits at the first support zone (0.86260)

Conclusion: EURGBP Forecast Outlook

The EURGBP is retracing upward after reaching 0.86260, but the overall 4-hour structure remains bearish. Price is expected to approach 0.87100, where traders should watch for bearish confirmations before entering sell positions. If bearish setups emerge, downside targets point back to 0.86260 and potentially lower.

GitHub Repo shadowrocket

https://raw.githubusercontent.com/iSteal-it/script/refs/heads/main/shadowrocket.configurationGitHub Repo Egern

https://apptesters.org/egern.yaml