Previous report on EURGBP : EURGBP Price Forecast Update: Fibonacci Levels and Market Outlook 28 AUG 2025

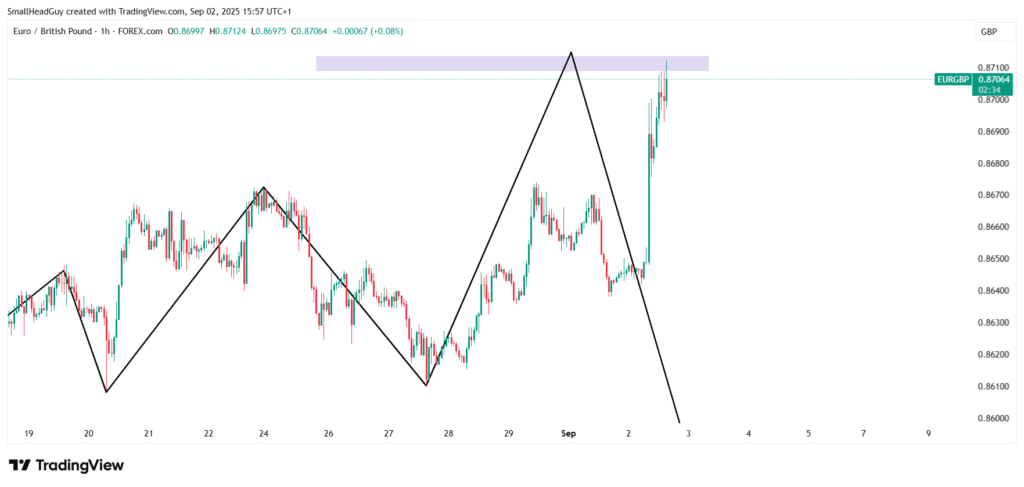

The EURGBP currency pair has been closely monitored after weeks of consolidation and measured bullish moves. In our previous price forecast, we highlighted the critical price level of 0.87130, noting that EURGBP was likely to test this zone before making its next major move. As predicted, price indeed touched 0.87130, and now market sentiment suggests that the next phase may be a sharp bearish correction.

Technical Overview

- Key Resistance Level: 0.87130

- Immediate Bearish Target: 0.86000

- Extended Downside Potential: Below 0.86000 if bearish momentum accelerates

On the daily timeframe, EURGBP has maintained a bearish bias in the long term despite short-term rebounds. The level of 0.87130 acted as a strong supply zone, capping bullish attempts. Price has failed to sustain above it, which increases the probability of a downside continuation.

Looking at the 4-hour timeframe, we see repeated rejection wicks around the resistance zone, confirming that sellers are stepping in at 0.87130. Market structure is beginning to shift toward lower highs and lower lows, indicating early signs of bearish dominance.

The 1-hour timeframe further strengthens this case. Momentum oscillators show divergence as price failed to break higher highs, while candlestick formations reveal exhaustion at the top. This aligns with our bearish outlook.

Bearish Outlook: Why 0.86000 Matters

If EURGBP continues to hold below 0.87130, the next major support lies at 0.86000. This level is technically significant for three reasons:

- Historical Support: Price has bounced multiple times from this area in recent months.

- Psychological Zone: The round number 0.86000 tends to attract market attention.

- Liquidity Cluster: Order flow suggests that a break toward 0.86000 could trigger stops and increase selling pressure.

If 0.86000 is broken convincingly, then the bearish move may extend even further, potentially opening the door for downside continuation toward 0.85400 and beyond.

Market Fundamentals

While technicals suggest a bearish path, fundamentals are also contributing to this setup.

- Eurozone: Recent economic reports show slowing growth in Germany and weaker-than-expected PMI data across the euro area. Inflation is easing, which reduces pressure on the European Central Bank (ECB) to maintain a hawkish stance. This softens support for the euro.

- United Kingdom: The Bank of England (BoE) has expressed concerns about sticky inflation, leaving the door open for potential tightening or at least delaying cuts compared to the ECB. This supports the pound against the euro in the near term.

The divergence between ECB’s dovish tilt and the BoE’s cautious stance favors downside risk for EURGBP.

also read : EURCHF Price Forecast: Bulls Eye 0.95200 After Breakout 1 September

Trading Strategy

- Sell Bias Below 0.87130: As long as EURGBP remains under this resistance, the bearish case is valid.

- First Target: 0.86000 – a strong support and profit-taking area.

- Extended Target: Below 0.86000, potentially 0.85400.

- Stop-Loss Placement: Above 0.87130 to invalidate the setup.

Risk Considerations

- If EURGBP manages to break above 0.87130 and hold, the bearish outlook weakens. In such a case, price may retest 0.87500 – 0.87800 resistance levels.

- Upcoming economic events, particularly from the ECB and BoE, could cause volatility and temporary spikes in either direction.

Outlook Summary

- Daily Bias: Bearish

- Key Resistance: 0.87130

- Targets: 0.86000 first, deeper downside possible

- Fundamental Drivers: Euro weakness from softer economic data, pound support from BoE stance

EURGBP has reached the forecasted resistance zone and is now showing signs of reversal. As long as the pair holds under 0.87130, the stage is set for the big fall toward 0.86000 and possibly lower.

read more : GBPUSD Price Forecast: Approaching Golden Resistance Zone at 1.35600 1 SEPT 2025