Scroll Down For ID

Recap of Previous EURGBP Forecast

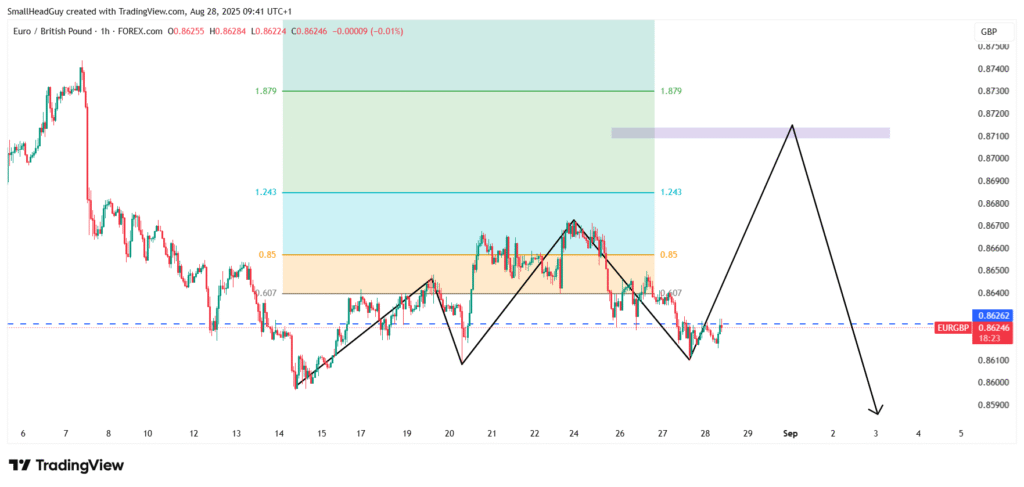

In our last report, we identified 0.86260 as a key Fibonacci level where EURGBP was showing bullish momentum. At that time, the pair was moving higher from this support, hinting at potential upward continuation.

EURGBP Price Forecast: Bulls Eye 0.87100 Before Potential Sell-Off

EURGBP continues to trade with mixed signals across multiple time frames. In our last report, we highlighted the importance of the 0.86260 Fibonacci level, where the pair found temporary support and attempted a move higher. Since then, price action has shifted. EURGBP broke below 0.86260, but instead of accelerating downward, it started forming a bullish structure just below this level. This indicates that buyers are still active and may be preparing for another attempt at higher levels.

However, the longer-term trend remains biased toward the downside, suggesting that any bullish rally could be short-lived before sellers reassert control.

Technical Outlook

Daily Time Frame: Bearish Bias Holds

On the daily chart, EURGBP continues to follow a bearish trajectory, characterized by lower highs and lower lows. Despite this, the pair has struggled to sustain momentum below 0.8600, signaling strong interest from buyers at lower levels. This price action suggests a corrective bullish move may still unfold before the bearish trend resumes.

Four-Hour Time Frame: Consolidation and Retest

The four-hour chart shows the pair consolidating around the 0.86260 mark. This Fibonacci retracement level has acted as a pivot, with multiple tests from both sides. The fact that bulls are defending this area implies that a breakout above could open the door for further upside.

One-Hour Time Frame: Bullish Structure Emerging

On the one-hour chart, price has been forming higher lows after the recent dip below 0.86260. If EURGBP manages to reclaim this level with a strong candle close, bullish momentum could carry it toward the 0.87100 Fibonacci level, which also aligns with a previous supply zone.

Key Levels to Watch

- Immediate Support: 0.8600

- Key Pivot: 0.86260 (Fibonacci level)

- Upside Target: 0.87100 (major Fibonacci level and resistance)

- Long-Term Downside Target: 0.8500

If EURGBP breaks convincingly above 0.86260, bulls could drive the pair toward 0.87100. However, once this target is reached, the probability of a reversal and strong sell-off increases, in line with the broader bearish trend.

Fundamental Outlook

European Central Bank (ECB)

The ECB has raised rates aggressively over the past two years to control inflation, bringing its deposit rate to 4.00%, the highest in history. However, eurozone economic growth has slowed significantly, particularly in Germany and France, raising fears of stagflation.

- Inflation is falling but remains above target.

- Growth indicators point to stagnation, with manufacturing in contraction.

- ECB policymakers have hinted at pausing rate hikes, with markets now anticipating cuts in 2024 if weakness persists.

This softer outlook puts the euro at risk, limiting its ability to sustain strong rallies against currencies like the pound.

Bank of England (BoE)

The Bank of England currently maintains its base rate at 5.25%, following a long series of hikes to combat persistent inflation in the UK. Unlike the eurozone, UK inflation remains stickier, especially in services and wages.

- Inflation remains one of the highest among developed economies.

- The BoE has taken a cautious approach, signaling that rates may stay elevated for longer.

- Resilient UK labor markets and services activity support the pound relative to the euro.

This divergence—ECB leaning toward cuts, BoE maintaining tight policy—provides fundamental support for a bearish longer-term EURGBP outlook.

Market Sentiment

- Risk Aversion: In risk-off environments, the euro tends to gain modest support, while the pound weakens.

- Yield Differentials: Higher UK yields relative to eurozone yields favor GBP strength over time.

- Geopolitical Factors: European political uncertainties and energy price fluctuations also weigh on the euro.

Trading Strategy

- Bullish Play Toward 0.87100:

Traders may look for confirmation of a break above 0.86260. If this happens, entries near 0.86300 could target 0.87100. Stops should be placed below 0.8600 to manage risk. - Bearish Setup Near 0.87100:

Given the broader bearish bias, traders should be alert for reversal candlestick patterns around 0.87100. A rejection at this level could trigger a strong sell-off, offering short opportunities with downside targets at 0.8600 and 0.8500. - Long-Term Outlook:

Selling rallies remains the preferred strategy while the daily structure is bearish and fundamental divergence favors GBP over EUR.

Conclusion

EURGBP remains at a pivotal stage. Although the longer-term structure points to continued bearish pressure, the current technical picture shows bulls preparing for a move higher. If price breaks above 0.86260, the pair could rise toward 0.87100, a key Fibonacci level and resistance zone.

However, traders should treat this bullish move as a corrective rally rather than a full trend reversal. The combination of a stronger Bank of England stance and weaker eurozone fundamentals makes it more likely that the pound will ultimately regain the upper hand. A failure at 0.87100 could confirm this, setting the stage for a renewed bearish leg, with potential downside targets extending toward 0.8500 in the coming weeks.