Scroll Down For ID

read more : GBPUSD Price Forecast: Approaching Golden Resistance Zone at 1.35600 1 SEPT 2025

Introduction to GBPNZD Analysis

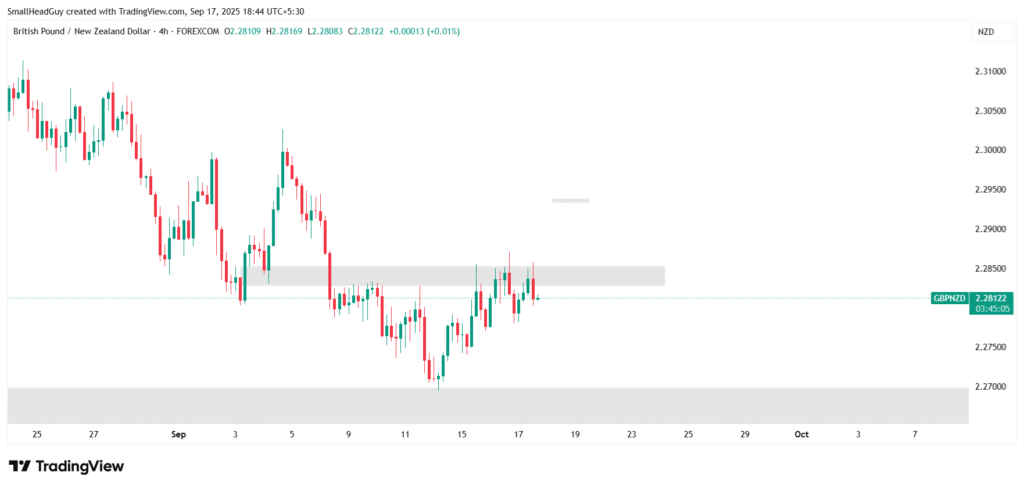

The GBPNZD analysis for September 2025 shows a market at a turning point. After several days of bullish activity, signs of weakness are beginning to appear. On the daily timeframe, bulls are losing momentum. The 4-hour chart shows price testing a critical resistance at 2.2860, while the 1-hour timeframe has printed a strong evening star candle formation. These signals together suggest that a potential downside correction is likely unless buyers step back in with force.

This article combines technical chart patterns with fundamental drivers to help traders prepare for the next moves.

Technical GBPNZD Analysis

Daily Timeframe: Bulls Losing Strength

On the daily chart, momentum indicators show that bulls are struggling. The candles have smaller bodies and longer wicks, reflecting rejection at higher levels. The Relative Strength Index (RSI) is flattening near overbought territory, hinting that buyers may no longer dominate.

If daily price closes below recent highs, it would confirm that the uptrend is weakening and that corrective moves are likely.

4-Hour Chart: Resistance at 2.2860

On the 4-hour timeframe, the price sits at a strong resistance zone around 2.2860. This area has previously acted as both support and resistance, making it a decisive level for traders. As long as the price stays below 2.2860, bearish pressure builds.

- Key Resistance: 2.2860

- Immediate Support: 2.27

- Next Major Support: 2.25

If the market fails to break 2.2860, we could see a move toward 2.27 and potentially 2.25.

read more : NZD/JPY Technical Analysis: Short-Term Bullish Outlook With Weekly Target at 93.000 16 Sep 2025

1-Hour Chart: Evening Star Candlestick

The 1-hour chart shows a textbook evening star candle pattern, a strong bearish reversal signal. This pattern typically forms at the top of an uptrend and indicates that buying momentum is exhausted. The confirmation candle in the pattern is large and bearish, adding weight to the downside outlook.

Indicators Supporting Bearish Outlook

- RSI: Flattening on the daily, pointing to momentum slowdown.

- MACD: On lower timeframes, histogram is turning negative, signaling bearish momentum.

- Moving Averages: Short-term EMAs are flattening, showing a loss of trend direction. If price closes below them, selling pressure could intensify.

- Fibonacci Retracement: Drawn from the recent swing low to swing high, the 38.2% retracement sits near 2.27 and the 61.8% level aligns closer to 2.25, matching downside targets.

Fundamental GBPNZD Analysis

Bank of England (BoE) Outlook

The Bank of England has maintained a cautious stance in 2025. While inflation in the UK has been moderating, wage growth and energy costs remain concerns. The BoE is balancing between holding rates steady and signaling possible cuts if economic growth slows. This cautious outlook reduces bullish support for GBP.

Reserve Bank of New Zealand (RBNZ) Stance

The Reserve Bank of New Zealand remains relatively hawkish. Inflation in New Zealand has been stubborn, and the housing market continues to show resilience. The RBNZ has hinted at keeping rates higher for longer, supporting NZD strength. This divergence in policy compared to the BoE tilts the medium-term outlook in favor of NZD.

Macro Factors

- UK Economic Data: Sluggish GDP and consumer confidence weigh on GBP.

- New Zealand Data: Strong export demand, especially from dairy and agricultural products, continues to support the kiwi.

- Global Risk Sentiment: In times of global risk-off sentiment, GBP often weakens faster than NZD due to its exposure to European uncertainties.

Scenario 1: Bearish Breakdown (Primary Outlook)

If GBPNZD maintains below 2.2860, the bearish scenario remains in play. Traders can expect a move toward 2.27 first, and if momentum continues, the next target would be 2.25.

- Entry Idea: Sell below 2.2860

- Target 1: 2.27

- Target 2: 2.25

- Stop-Loss: Above 2.29 for protection

Scenario 2: Bullish Invalidation

The bearish outlook would be invalidated if price breaks and sustains above 2.2860. In that case, bullish momentum could return, pushing the pair back toward 2.30 and higher.

- Entry Idea: Buy on a confirmed breakout above 2.2860

- Target 1: 2.2950

- Target 2: 2.30

- Stop-Loss: Below 2.28

Risk Factors in GBPNZD Analysis

- Central Bank Surprises: Unexpected rate decisions from BoE or RBNZ could shift sentiment abruptly.

- Economic Data Releases: Employment, inflation, and GDP figures from both economies may create volatility.

- Geopolitical Developments: UK trade relations and global market shocks can influence GBP.

- Commodity Prices: As New Zealand is a commodity-linked economy, fluctuations in dairy and agricultural markets directly affect NZD.

Conclusion: Final GBPNZD Analysis

This GBPNZD analysis highlights a weakening bullish trend and increasing bearish momentum. On the daily timeframe, bulls are losing steam. The 4-hour chart shows strong resistance at 2.2860, while the 1-hour chart confirms a bearish reversal with an evening star candlestick.

Unless price breaks above 2.2860, downside targets remain at 2.27 and 2.25. Fundamentals also align with this bearish case, as the BoE remains cautious while the RBNZ maintains a hawkish tone.

For traders, risk management is key: monitor price behavior around 2.2860, as it will decide whether the pair continues lower or invalidates the bearish setup.

read more : USDCAD Price Forecast: Pullback Expected Before Bullish Opportunity 15 September 2025