our previous report : GBPUSD Short-Term Buy Setup: Fibonacci Levels, Consolidation, and Breakout Strategy 27 AUG 2025

Technical Outlook

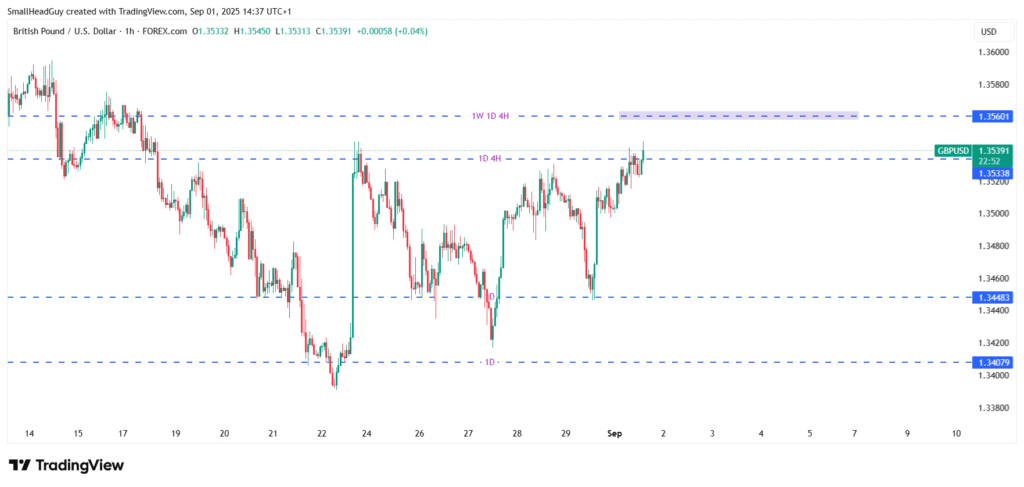

The British pound has been consolidating with mixed directional bias in recent weeks, but current chart formations suggest that GBPUSD is approaching a critical juncture. The so-called “golden resistance zone” around 1.35600 could mark the turning point for the next big move.

- Daily Chart

The overall market structure has shifted bearish. On the daily timeframe, GBPUSD has been producing lower highs and lower lows, a classic indicator of downside pressure. This longer-term structure suggests that sellers still hold control. - 4-Hour Chart

Despite the bearish backdrop, the pair is attempting a final push higher. Liquidity hunts are common before major reversals, and the 4-hour chart indicates that buyers may try to test the 1.35600 zone before bears re-enter strongly. - 1-Hour Chart

The shorter-term chart mirrors this expectation. Momentum is climbing, showing that intraday buyers are pressing for a test of resistance. However, this upward push looks corrective rather than the start of a new bullish trend. - Golden Resistance Zone: 1.35600

This level is especially important because it combines weekly, daily, and 4-hour resistance zones. Confluence zones like these often act as magnets for price before serving as major reversal points. If GBPUSD rallies into this zone, a significant sell-off could follow.

Fundamentals: Bank of England (BoE)

The Bank of England’s monetary policy plays a central role in GBP direction.

- Policy Rate Cuts

The BoE has recently reduced its policy rate to 4.00%, its lowest since March 2023. This follows five rate cuts since August 2024, reflecting efforts to stimulate a slowing economy. - Inflation Pressures

UK inflation remains elevated, still hovering near 3.6%, well above the 2% target. Policymakers face the difficult balance of cutting rates to support growth while ensuring inflation doesn’t re-accelerate. - Growth & Employment

The UK economy is barely growing, with GDP showing only 0.1% expansion. Meanwhile, unemployment has risen to 4.7%, the highest in four years. Rising joblessness adds political and economic pressure for further easing. - BoE Policy Outlook

Some policymakers remain cautious. For instance, MPC member Catherine Mann recently stated there is a case for a “persistent hold” to ensure inflation trends lower. Still, if growth weakens further, more cuts may be unavoidable.

Overall, the BoE’s stance is leaning dovish, which typically weighs on GBP.

Fundamentals: U.S. Federal Reserve (Fed)

On the other side of the currency pair, the Federal Reserve’s decisions are equally critical.

- Current Policy Rate

The Fed currently maintains its benchmark interest rate in the 4.25%–4.50% range, after a period of aggressive tightening. - Forward Guidance

Fed Governor Christopher Waller has hinted at a possible series of cuts over the next six months, potentially starting in September 2025, if economic conditions continue to soften. - Inflation & Employment

Inflation in the U.S. remains slightly above target, at around 2.9%, but the labor market is cooling. Job growth has slowed, and wage pressures are easing, giving the Fed room to pivot toward easing. - Political Pressure on the Fed

Some concerns have emerged about Fed independence, particularly as U.S. elections approach. Political influence could weigh on policy credibility, which in turn might affect USD sentiment.

For now, the Fed appears cautious, with easing on the horizon but not immediate. This makes the USD outlook slightly softer, but timing remains uncertain.

Relative Policy Dynamics: GBP vs USD

- The BoE has already started cutting rates, while the Fed is only preparing the ground for easing.

- This difference in timing could narrow interest rate differentials in favor of the USD, pressuring GBPUSD lower once short-term rallies fade.

- Market participants are watching UK inflation data and U.S. labor market releases closely, as these will guide central bank actions.

read more : EURCHF Price Forecast: Bulls Eye 0.95200 After Breakout 1 September

Trading Scenarios

Here’s a structured view of possible setups:

| Scenario | Price Action | Trading Bias |

|---|---|---|

| Final push into 1.35600 | Price rallies to golden resistance zone | Look for bearish reversal patterns (e.g., double top, engulfing candles) |

| Rejection at 1.35600 | Failed breakout, strong wick rejections | Enter short trades targeting 1.3500 → 1.3450 → 1.3400 |

| Clean break above 1.35600 | Sustained daily close above zone | Short-term bullish continuation possible toward 1.3620, but high risk |

| No rally, immediate drop | Price fails to reach 1.35600 | Look for shorts on breakdowns of 1.3450 |

Risk Management:

Stops should be placed just above 1.35600, allowing room for volatility. Position sizing should account for potential sharp whipsaws near resistance.

Summary & Outlook

GBPUSD is approaching its golden resistance zone at 1.35600, a confluence of key technical levels across multiple timeframes. While the pair may attempt one last rally into this zone, the broader technical and fundamental picture suggests limited upside.

The Bank of England’s dovish rate cuts, combined with the Federal Reserve’s cautious but still tighter stance, create conditions where GBP strength is likely temporary. Once liquidity is grabbed at 1.35600, bears are expected to take control, potentially driving the pair toward 1.3400 and lower in the coming weeks.

For traders, the strategy remains clear: sell into strength at golden resistance, with confirmation from bearish reversal signals.

read more : NZDUSD Final Bullish Move Before a Big Sell-Off 28 AUG 2025