read previous report : NZDUSD Final Bullish Move Before a Big Sell-Off 28 AUG 2025

Introduction

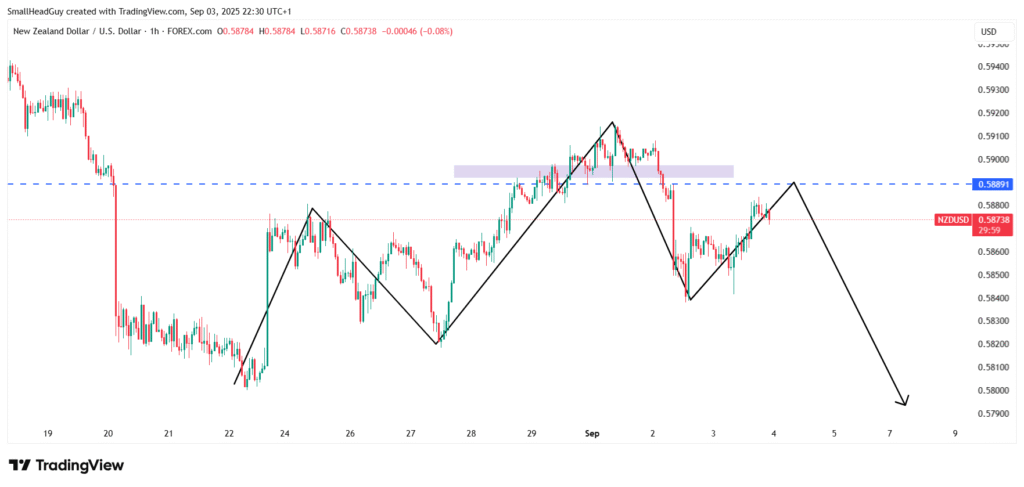

This is an update to our previous NZDUSD price forecast, where we highlighted the possibility of one last upward move before a bigger sell-off. As predicted, NZDUSD rallied up to the 0.58900 level before reversing downward. Today’s outlook suggests that the pair may attempt a short retracement back to 0.58900 before resuming its bearish trend. Traders should remain cautious and look for bearish confirmation patterns below this level to position themselves for the downside move.

NZDUSD Technical Outlook

Daily Time Frame

On the daily chart, NZDUSD remains locked in a long-term bearish structure. The pair has been consistently forming lower highs and lower lows, a clear signal that sellers are dominating. The bounce up to 0.58900 was corrective in nature rather than the start of a fresh bullish cycle.

If the bearish structure continues, we expect the pair to retest lower supports in the coming sessions, especially if the 0.58900 retracement gets rejected.

4-Hour Time Frame

The 4-hour chart provides additional clarity. The upward move toward 0.58900 was accompanied by declining momentum, suggesting weakness in bullish pressure. After touching this resistance, NZDUSD turned lower, confirming that sellers are stepping back into the market.

Currently, price action shows signs of consolidation before potentially retesting 0.58900. If it fails again at this level, sellers will likely accelerate the move downward.

1-Hour Time Frame

The 1-hour chart shows short-term corrective moves, typical of retracements. For traders looking for entries, the 0.58900 zone is crucial. A bearish rejection pattern—such as a bearish engulfing candle or a shooting star—around this level could serve as a strong short-entry signal.

Key Support and Resistance Levels

- Immediate Resistance: 0.58900

- Next Resistance: 0.59250

- Immediate Support: 0.58400

- Next Support: 0.58100

- Extended Downside Target: 0.57700

These levels outline the battlefield for bulls and bears. As long as NZDUSD remains below 0.58900, the bearish bias is valid. A clean break above this level would weaken the bearish case, though the broader structure still favors the downside.

Bearish Patterns to Watch

Traders should wait for bearish confirmations at or below 0.58900 before entering positions. Key signals include:

- Bearish Engulfing Candle: Strong reversal signal at resistance.

- Double Top Formation: Two failed attempts to break above 0.58900.

- Lower High Formation: Price failing to create a higher high near resistance.

If any of these patterns emerge, they increase the probability of a sharp downward move.

Fundamental Drivers Behind NZDUSD

While technicals guide the short-term moves, fundamentals also add weight to the bearish outlook:

- New Zealand Economy: The Reserve Bank of New Zealand (RBNZ) has shifted toward a more cautious stance, with policymakers signaling concern over slowing growth. Although inflation is moderating, weak consumer demand and falling business confidence are weighing on the NZD.

- U.S. Dollar Strength: The U.S. Dollar remains supported by the Federal Reserve’s tighter stance compared to other central banks. Even if future cuts are on the horizon, the Fed’s commitment to controlling inflation keeps USD demand strong.

- Commodity Prices: As a commodity-linked currency, the NZD is vulnerable to declines in global demand. Recent weakness in commodity markets, particularly dairy exports, has added to bearish NZD pressure.

These fundamentals align with the technical setup, reinforcing the bearish forecast for NZDUSD.

also read : Bitcoin Price Forecast: Bears Finally Taking Control (Targets $98K – $99K)

Trading Strategy for NZDUSD

- Entry Zone: Look for short entries if price retests 0.58900 and rejects.

- Stop Loss: Place stops just above 0.59250 to protect against false breakouts.

- Targets:

- First Target: 0.58400

- Second Target: 0.58100

- Extended Target: 0.57700

This strategy provides a favorable risk-to-reward ratio while aligning with both the technical and fundamental outlooks.

Risk Considerations

- If NZDUSD breaks and closes above 0.59250, the bearish outlook may be invalidated, opening the door for a short-term rally.

- Traders should monitor high-impact economic data releases, such as U.S. inflation or employment figures, which could cause volatility.

- Unexpected policy announcements from the RBNZ or the Federal Reserve could alter sentiment abruptly.

Outlook Summary

- Bias: Bearish below 0.58900

- Short-Term Retracement: Likely toward 0.58900 before falling again

- Key Levels to Watch: Resistance at 0.58900, support at 0.58400 and 0.58100

- Bearish Target Zone: 0.57700 in the medium term

As long as NZDUSD remains capped below 0.58900, the bearish outlook is intact. A small retracement to this level could provide traders with the perfect setup to short the pair and target lower levels.

also read : GBPUSD Short-Term Buy Setup: Fibonacci Levels, Consolidation, and Breakout Strategy 27 AUG 2025