Scroll Down For ID

our previous report : NZDUSD Price Forecast: Retracement to 0.58900 Before the Next Fall 4 SEP 2025

Introduction

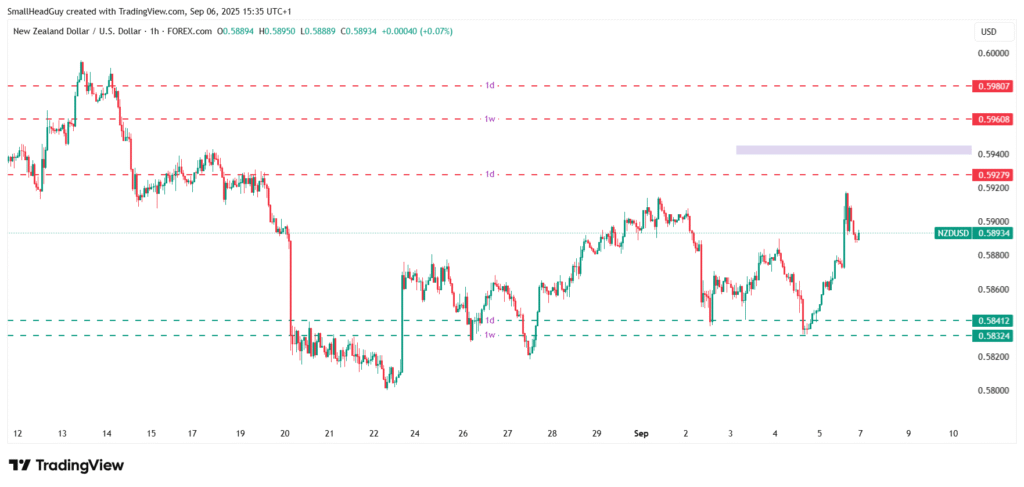

In our previous forecast, we observed that NZDUSD could deliver a final upward retracement toward 0.58900 before resuming its decline. That move has materialized—NZDUSD did rise to 0.58900. Now we expect another retracement toward that level before the next leg down.

This updated analysis explores the current technical structure, defines key support and resistance zones, and integrates fresh insights from both the Reserve Bank of New Zealand (RBNZ) and the U.S. Federal Reserve (Fed) to validate a continued bearish outlook.

Technical Analysis

Daily Chart Structure (Bearish)

On the daily timeframe, NZDUSD remains under bearish control. Price formed a head-and-shoulders pattern earlier, validating our bearish view. The rebound toward 0.58900 is corrective, not trend-reversing.

Resistance Zones to Watch

- 0.58900 — The prior peak, now a key resistance.

- 0.59250 — Daily resistance.

- 0.59400 — Fibonacci level.

- 0.59600 — Weekly resistance.

- 0.59800 — Higher daily resistance.

We expect price to head back into these zones before resuming the downtrend.

Support Levels

- 0.58400 — Daily support.

- 0.58300 — Weekly support zone.

If NZDUSD establishes a bearish structure below 0.58900, the first downside target is 0.58400, followed by 0.58300 and lower.

Trading Approach

- Wait for a retracement into 0.58900–0.59400 zone.

- Look for bearish confirmation patterns (e.g., bearish engulfing, double top).

- Enter short at or below 0.58900.

- Set stop just above 0.59800.

- Target range: 0.58400 → 0.58300.

read more : NZDJPY Forecast bulls taking control 29 AUG 2025

Fundamental Context

Reserve Bank of New Zealand (RBNZ)

The RBNZ recently cut its OCR to 3.00%, the lowest in three years, citing a stalling recovery and economic headwinds. It signaled further easing—potential reductions toward 2.55%—as growth falters and inflation moderates. This dovish stance continues to weigh on the NZD.

Reuters

Financial Times

U.S. Federal Reserve (Fed)

The latest U.S. jobs data revealed a sharp slowdown—only 22,000 new jobs added in August, pushing unemployment to 4.3%. This surprise weakness has intensified expectations for imminent rate cuts, likely starting in September and possibly followed by more.

The GuardianReutersThe Wall Street JournalInvestors

A weaker U.S. labor market and dovish Fed lean encourage USD softness over time, which provides slight support for NZDUSD; yet the RBNZ’s aggressive easing likely remains the dominant driver.

Combined Technical and Macro Outlook

The NZDUSD outlook remains bearish:

- Technically, the head-and-shoulders and the inability to breach 0.58900 reinforce selling pressure.

- Fundamentally, RBNZ’s continued easing momentum weakens NZD. While Fed easing could temper USD strength, the RBNZ’s policy path appears more aggressive.

This reinforces the strategy of selling at resistance, with caution toward retracement traps.

Trading Strategy: Summary Table

| Stage | Action Plan |

|---|---|

| Retrace to 0.5890–0.5940 | Watch for bearish confirmations |

| Enter Short | At or below 0.58900 with confirmation |

| Stop-Loss | Just above 0.59800 |

| Targets | 0.58400 → 0.58300 (first swing levels) |

| Broader Bias | Bearish unless price convincingly breaks above 0.59800 |

Outlook Summary

- Daily Bias: Bearish, validated by the head-and-shoulders structure.

- Retracement Zone: 0.58900–0.59400 offers best entry point for shorts.

- Downside Targets: 0.58400 → 0.58300 if setup confirms.

- Fundamentals: RBNZ cutting rates to 3.00% with more easing signaled. Fed responding to weak jobs data with likely cuts ahead.

In short, NZDUSD appears set for a final retracement to 0.58900 before continuing its descent. Traders should align with the sell-side bias and look for clean setups at resistance zones to navigate the next leg lower.

read more : Bitcoin Price Forecast: Bears Finally Taking Control (Targets $98K – $99K)